Insurance Horror Stories?

In a September 22, 2006 NY Times Op-Ed article (subscription required), Paul Krugman cites a September 17 Lisa Girion article in Los Angeles Times article entitled "Sick but Insured? Think Again" and, carrying that theme, argues that the current incentive structures pit parties against the best medical interests of the individual. He states "cruelty and injustice are the inevitable result of the current rules of the game."

Krugman makes the following claims without reference:

Where do those numbers come from? This writer is going to try to find out and put the evidence on this blog. (Help is welcome.)

One source may be Holohan and Cook's November 5, 2005 Health Affairs article entitled "Changes In Economic Conditions And Health Insurance Coverage, 2000-2004."

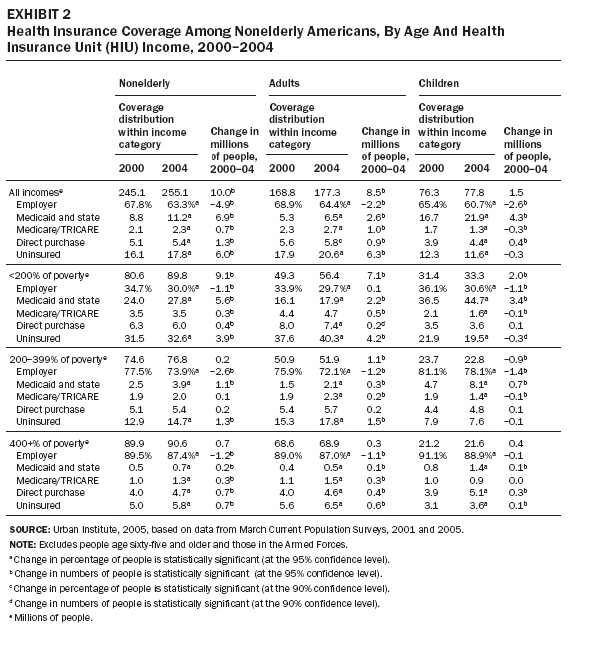

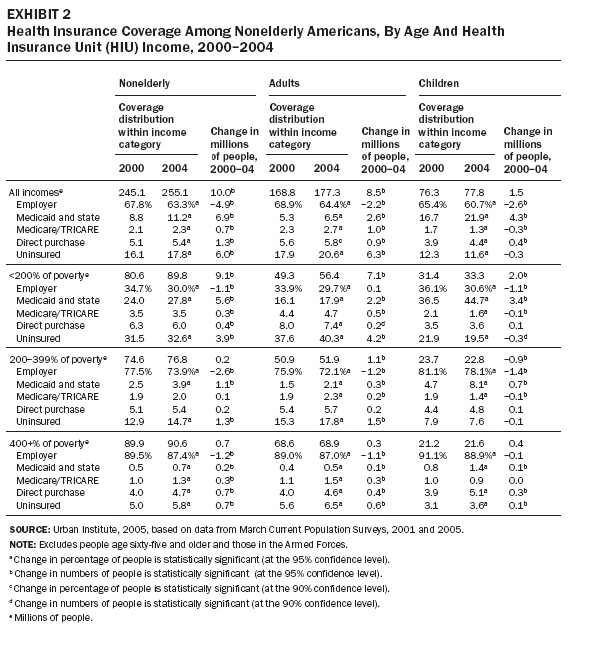

Using data from the 2001 and 2005 March Supplements to the Current Population Survey, the number of uninsured Americans increased by six million, primarily because of a decline in employer-sponsored insurance. All of the increase occurred among adults, for whom the drop in employer coverage was not offset by an increase in public coverage. 4.9 million fewer people had employer-covered insurance at the end of the period than at the beginning of the period. Medicaid and state-insured increased by 6.9 million and the uninsured increased by 6 million. Although a surge in population increased the near-elderly uninsured slightly, most of the uninsured came from low income, younger groups. The drop in employer coverage was in part the result of the economic recession and a decrease in employment.

Krugman makes the following claims without reference:

Health care is poised to become America's largest industry. Employment in manufacturing, which once dominated the economy, has fallen 18 percent since 2000, to 14.2 million. Meanwhile, employment in the private health services industry has risen 16 percent, to 12.6 million. Another 1.3 million people are employed at government hospitals. So we're quickly approaching the point at which more Americans will be employed delivering health care than are employed producing manufactured goods.A more startling assertion:

Between 2000 and 2005, the number of Americans with private health insurance coverage fell by 1 percent. But over the same period, employment at health insurance companies rose a remarkable 32 percent.

Where do those numbers come from? This writer is going to try to find out and put the evidence on this blog. (Help is welcome.)

One source may be Holohan and Cook's November 5, 2005 Health Affairs article entitled "Changes In Economic Conditions And Health Insurance Coverage, 2000-2004."

Using data from the 2001 and 2005 March Supplements to the Current Population Survey, the number of uninsured Americans increased by six million, primarily because of a decline in employer-sponsored insurance. All of the increase occurred among adults, for whom the drop in employer coverage was not offset by an increase in public coverage. 4.9 million fewer people had employer-covered insurance at the end of the period than at the beginning of the period. Medicaid and state-insured increased by 6.9 million and the uninsured increased by 6 million. Although a surge in population increased the near-elderly uninsured slightly, most of the uninsured came from low income, younger groups. The drop in employer coverage was in part the result of the economic recession and a decrease in employment.

0 Comments:

Post a Comment

<< Home